Secure Business Funding Today:

Contact VIP | Business Credit

Home >> Contact

We’re Here to Help

Have questions, need help with a booking, or just want to speak to

our team? Reach out we’re happy to assist.

Get in Touch

Address

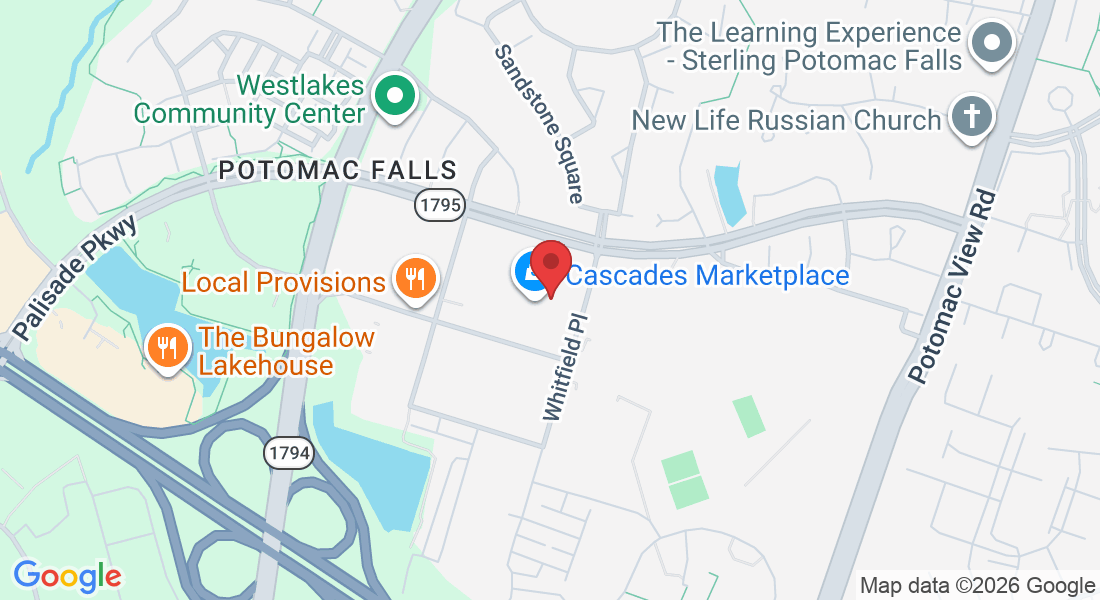

21000 Southbank St. Ste 106-380, Sterling, VA 20165

Phone Number

(571) 248-3863

Office Hours:

Monday – Friday:

9:00 AM – 6:00 PM

Building a successful business in Northern Virginia takes more than passion.